BNY’s AI Strategy Is Working: Here’s What Insurers Should Copy

Welcome to DX Brief - Insurance, where every week, we interview practitioners and distill industry podcasts and conferences into what you need to know

In today's issue:

BNY's "AI for Everyone, Everywhere, Everything" strategy is delivering real results

How Generali’s CIO is building AI-native team readiness

Insurance <> bank convergence is accelerating to drive higher customer engagement and trust

1. BNY's "AI for Everyone, Everywhere, Everything" strategy is delivering real results

Next to Lead podcast, Episode: How the bank founded by Alexander Hamilton is transforming for the future of finance with Cathinka Wahlstrom, Chief Commercial Officer (Dec. 1, 2025)

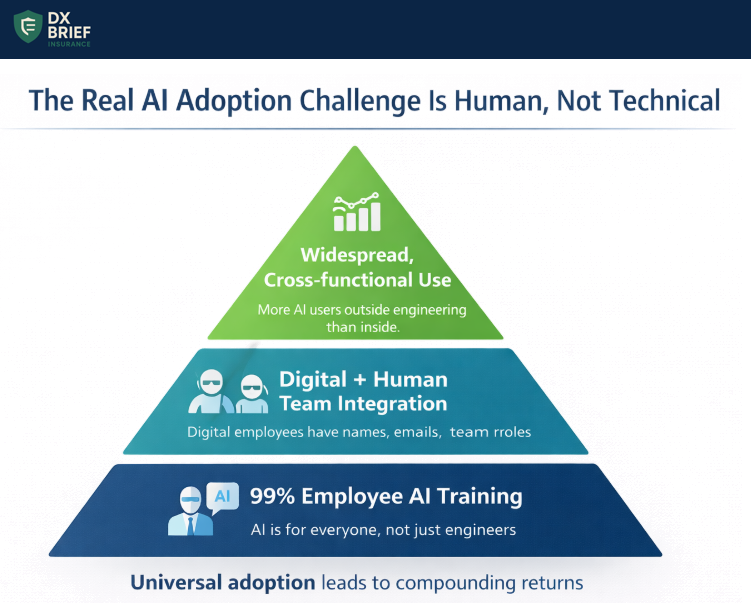

Background: An MIT study found that 95% of companies aren't seeing value from AI. BNY, the 240-year-old bank founded by Alexander Hamilton overseeing $57.8 trillion in assets and serving 90%+ of Fortune 500 companies, claims to be in the 5%, with 99% of employees trained, over 100 digital employees working alongside humans, and more AI users outside engineering than in it.

TLDR:

The biggest barrier to AI value is adoption. BNY's "AI for everyone, everywhere, for everything" mantra drove 99% training rates and more users outside engineering than inside.

Treating AI as team members rather than tools changes how organizations integrate the technology. At BNY, digital employees have names, emails, and work on teams alongside humans.

De-siloing beats optimization: BNY had 11 different client satisfaction surveys to the same client, 8 call centers, and 5 loan platforms. Unifying beats automating fragments.

Human adoption is the constraint, not technology. "I actually don't think technology is why companies don't feel like they're making progress. It's more human adoption." BNY built their entire strategy around this. The mantra "AI for everyone, everywhere, for everything" isn't marketing – it's an adoption strategy.

By making AI universal rather than specialized, they removed the perception that AI was "for the engineers." The result: 99% of employees trained, and there are now more AI users outside engineering than inside it.

Most insurers deploy AI in pockets like claims processing, underwriting models, chatbots. BNY made a different bet: universal adoption creates compounding returns that specialized deployment never will.

Treat AI as team members, not tools. BNY has over 100 "digital employees" with names, email addresses, and team assignments. They work alongside human employees, who review their work.

This isn't anthropomorphization for its own sake. It's a deliberate organizational design choice.

When you give AI agents identities and integrate them into team structures, you change how humans interact with them. The employee reviewing AI output isn't "checking a system" – they're collaborating with a team member.

Unify before you automate. When Robin Vince took over as CEO, BNY had incredible individual businesses… but they weren't unified. The commercial function had 11 different client satisfaction surveys going to the same clients. 8 different call centers. 5 different loan platforms.

The insight: "No one has quite a combination of business that we do, but what we hadn´t quite done was to make them work together."

Most insurers try to optimize individual processes with AI. BNY's approach: first de-silo, then unify, then automate.

A fragmented organization automating fragments just creates faster chaos. A unified organization automating unified processes creates compounding efficiency.

What to do about this:

→ Audit your current AI deployment for the "pockets" problem. Map every AI initiative across your organization. If they're isolated in specific departments without cross-functional adoption, you're likely in the 95% not seeing value.

→ Run a "de-siloing" diagnostic before your next AI investment. How many systems touch the same customer? How many surveys? How many touchpoints? Address fragmentation before automation.

→ Pilot the "digital employee" framing. For your next AI agent deployment, give it a name, an identity, and a team assignment. Measure whether human collaboration patterns change

2. How Generali’s CIO is building AI-native team readiness

Futureproof podcast, Episode: Building an AI-Native Enterprise with George Bock, CIO at Generali Global Assistance (Dec. 5, 2025)

Background: George Bock has spent 20 years leading enterprise transformations – from cloud migrations to M&A integrations – and now as CIO at Generali Global Assistance, he's preparing a decades-old insurance enterprise for an AI-native future.

TLDR:

Run SWOT analyses on your teams before launching AI initiatives: understanding capability gaps and hidden strengths matters more than selecting the perfect tool.

Start AI deployment internally (IT help desks, knowledge bases) before external customer service – the ROI is faster and the learning curve safer.

Data hygiene is non-negotiable: without clean, governed data foundations, AI will "do a lot of damage" through hallucinations and bad decisions.

Assess your teams before your tools. Most CIOs evaluate AI vendors first. Bock does the opposite. He recently had his leadership team conduct SWOT analyses of their own Where do you feel we are at? Where do you feel we're going to be? And how are we going to ensure that we can embrace the new technology landscapes that we're moving towards?"

The results were "eye-opening" and spawned conversations that vendor demos never would. Why? Because AI readiness isn't about the technology. It's about whether your people can operate alongside it.

Most insurers approach AI as a tool selection problem. Bock treats it as a team development problem. "Don't be afraid to move those pieces of the puzzle around.” You may discover capabilities you didn't know existed. People who can bridge the gap between business and technical teams, or hidden expertise that becomes critical in an AI-augmented environment.

Deploy AI internally before externally. The low-hanging fruit isn't customer-facing chatbots. It's internal knowledge bases that eliminate the hours employees waste "fumbling around trying to find an answer."

Insurance companies accumulate "silos of stuff everywhere.” Much of it is duplicative, outdated, or contradictory. AI can surface the right answer "lightning fast," but only if you've done the internal deployment work first.

The strategic logic: internal AI deployments have lower risk, faster feedback loops, and build organizational confidence before you put AI in front of policyholders.

Data hygiene is a prerequisite, not an afterthought. Without data governance, data definitions, and data hierarchies, AI can "actually do a lot of damage." Bad data leads to bad recommendations, which leads to bad claims decisions, which leads to regulatory and customer trust problems.

Bock's prescription: data governance, identifying your data, eliminating silos, data definitions, data hierarchies. Only then do you layer AI on top. The insurers who skip this step will spend the next two years cleaning up AI-generated messes.

Prepare for the "middle layer" to disappear. Bock's prediction is that within 5-10 years, "much of what we consider that middle ground of many IT organizations is going to start to get whittled away." As AI reaches "super agency" – able to do critical thinking and orchestration – mid-level decision-making roles will fundamentally change or be eliminated.

But here's the The insurance leaders who win will be those who prepare their organizations for this shift now, not those who wait for it to happen to them.

What to do about this:

→ Schedule team SWOT sessions before your next AI initiative. Have each department lead assess their team's AI readiness: current capabilities, skill gaps, hidden strengths, and threats to adoption. Use findings to inform training investments and restructuring before tool selection.

→ Pilot AI on internal knowledge management first. Deploy an AI-powered internal search tool for IT help desk, claims procedures, or underwriting guidelines. Measure time-to-answer improvements before considering customer-facing deployments.

→ Audit your data governance maturity. Before any AI deployment, answer: Do we have clear data definitions? Are our data silos mapped? Is there a single source of truth for key operational data? If not, prioritize data hygiene over AI experimentation.

3. Insurance <> bank convergence is accelerating to drive higher customer engagement and trust

Deloitte Africa fireside chat: A pivotal analysis for the future of insurance in Africa and beyond with Gerdus Dixon and Andrew Warren (Dec. 4, 2025)

Background: Beneath the strong performance of South African insurance companies lies a structural transformation: Discovery is leveraging bank technology across its group, Old Mutual is launching a bank with customer communication at its center, and Sanlam is building a "super app" merging banking, insurance, and rewards. Meanwhile, Capitec (a bank) just got its insurance license, and telecom giants MTN and Vodacom are selling insurance products. The "single view of customer" holy grail is finally becoming possible, and it's reshaping who competes with whom.

TLDR:

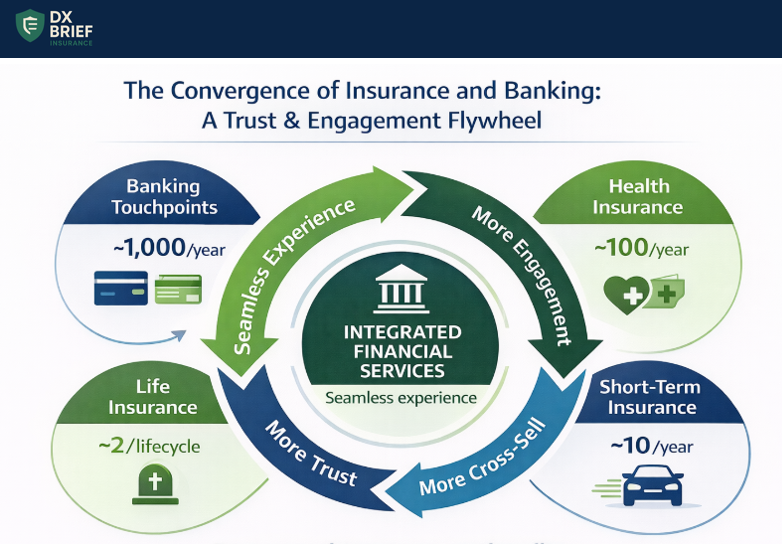

Insurance-bank convergence is accelerating: major insurers are acquiring or building banks, while banks are entering insurance, both chasing the "single view of customer" that increases trust and cross-sell potential.

Customer interaction frequency is the strategic driver: banks get ~1,000 touchpoints annually, health insurers ~100, short-term insurers ~10, life insurers often just 2 (at purchase and claim) – integrated offerings solve this gap.

Convergence is about interaction frequency, not product bundling. A typical consumer connects with their bank about 1,000 times per year (transactions, app logins, payments). They connect with their health insurer maybe 100 times. Their short-term insurer? Perhaps 10 times; if they're unlucky enough to file claims. Their life insurer? "Generally at the beginning and often at the end of the product life cycle."

This asymmetry is the strategic problem. Trust builds through frequent interaction. When Discovery uses bank technology "from a group perspective" or Old Mutual puts "the bank at the center" of customer communication, they're solving the interaction frequency problem; not just creating product bundles. The super app strategy from Sanlam/Tyme does exactly this: create a reason for daily engagement that insurance alone could never provide.

The "single view of customer" is finally possible. For years, achieving a unified customer view meant pulling all data into one place and doing matching – a data integration nightmare. "The ability to do that at the front end across the platforms is becoming more apparent." Technology has evolved to enable real-time customer views without massive backend consolidation.

What does this mean practically? When you can see the customer across insurance, banking, and payments simultaneously, you can "build trust across all of them." The back-office integration of policy recordkeeping systems has improved enough that "the front end looks seamless to the customer." This is the holy grail that integrated financial services providers have chased for decades.

What to do about this:

→ Calculate how often you touch each customer segment annually. Compare to banks, health insurers, and digital-first entrants. Identify the gap and develop a strategy to increase touchpoints that aren't claims-driven.

→ Can you see each customer across all products and channels in real-time? If not, prioritize front-end integration that enables unified customer experiences without requiring complete backend data consolidation.

Disclaimer

This newsletter is for informational purposes only and summarizes public sources and podcast discussions at a high level. It is not legal, financial, tax, security, or implementation advice, and it does not endorse any product, vendor, or approach. Insurance environments, laws, and technologies change quickly; details may be incomplete or out of date. Always validate requirements, security, data protection, regulatory compliance, and risk implications for your organization, and consult qualified advisors before making decisions or changes. All trademarks and brands are the property of their respective owners.