30% of Underwriters Are Retiring: Here’s How AI Fills the Gap

Welcome to DX Brief - Insurance, where every week, we interview practitioners and distill industry podcasts and conferences into what you need to know

In today's issue:

30% of underwriters are retiring – how can AI fill the gap?

Definity’s AI adoption playbook: democratize access, showcase early wins, formalize in performance reviews

Amwins’ AI adoption experience: why generic LLMs fail in insurance workflows

1. 30% of underwriters are retiring – how can AI fill the gap?

AI Heroes & Headaches podcast, Episode: 30% of Underwriters Are Retiring… Only Data and AI Can Stop the Crisis with Alex Schmelkin, Founder and CEO of Sixfold (Dec. 5, 2025)

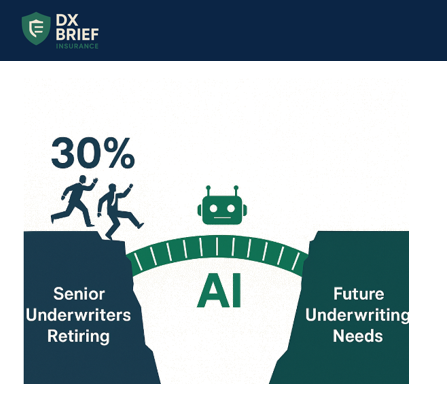

Background: Alex Schmelkin has built Sixfold into an AI platform that's helping underwriters write 30% more premium per person – from $5 million to $7 million annually. Here's what makes this urgent: 30% of senior underwriters are retiring in the next five years, taking decades of institutional knowledge with them. Two years ago, the pitch was "AI as copilot." Today, customers are demanding fully autonomous agents that underwrite risk end-to-end. The shift happened faster than anyone predicted, and carriers who don't adapt are flying blind.

TLDR:

The industry faces a 30% senior underwriter retirement wave in 5 years. Without AI, carriers can't maintain current premium levels, let alone grow.

AI has evolved from "analysis tool" to "autonomous agent" in just 24 months. Customers that laughed at autonomous underwriting two years ago are now deploying it.

The single biggest predictor of AI success is CEO involvement. When leadership leans in, implementation succeeds; when they delegate it to committees, it stalls.

From copilot to autonomous agent: the 24-month acceleration. When Sixfold launched two years ago, they positioned themselves as a "friendly AI assistant" that could analyze risk and point underwriters in the right direction.

That framing is already obsolete. Customers now expect AI agents to go off, complete underwriting work, connect to backend systems, generate quotes, and bring decisions back for human review. The shift from "show me insights" to "do the work for me" happened in just 24 months.

Why does this matter? Because if you're still planning for AI as a summarization layer, you're building for a world that no longer exists. The most successful underwriters now treat AI as a "robot hitched to their side" that they send on side quests – retrieving data, running pricing models, drafting quotes – while they focus on relationship-building and complex judgment calls.

The 30% problem with an AI solution. Here's the structural challenge nobody's solved without AI: 30% of senior underwriters – the people who know how to protect the balance sheet and sell the best risks – are retiring in 5 years. These aren't easily replaceable. Each one represents decades of pattern recognition, relationship capital, and institutional knowledge.

Sixfold's data shows their AI helps underwriters write 30% more gross written premium per person. That's not a coincidence – it's the minimum efficiency gain required just to maintain current capacity as talent exits. Carriers who view AI as a "nice to have" productivity tool are missing the math: this is existential capacity planning.

Accuracy frameworks beat constant feedback loops. Sixfold's biggest early mistake was asking underwriters to evaluate AI output quality. The response was We don't have time to tell you what's right and wrong – your technology needs to work."

The solution was to invest in internal accuracy measurement so Sixfold could show up saying "we're 87% aligned with your underwriting decisions" rather than asking customers to grade homework.

This has broader implications for any AI deployment. If your implementation plan includes "users will provide feedback to improve the model," you're creating friction that kills adoption. Build accuracy measurement into the system from day one.

What to do about this:

→ Audit your underwriting workforce age distribution. Calculate what percentage of your senior underwriters will be eligible for retirement in 3, 5, and 7 years. Quantify the premium at risk if that capacity disappears without AI augmentation.

→ Reframe your AI business case around gross written premium per underwriter. Stop measuring AI success in "time saved" or "documents processed." The metric that matters is revenue per underwriter.

→ Get your CEO personally involved in AI deployment. The single factor that predicts outsized success is when the CEO themselves leans in. Not delegates to a committee, not sponsors from afar – personally involved in metrics, accountable for outcomes.

2. Definity’s AI adoption playbook: democratize access, showcase early wins, formalize in performance reviews

Digital Insights by Kurios, Webinar: AI Transformation in the Insurance Industry with Daniel Kennedy, CDO @ Definity (Dec. 5, 2025)

Background: Daniel Kennedy runs Sonnet, Canada's first fully digital direct-to-consumer insurance company, and a pet insurance business – both under Definity, Canada's fourth-largest P&C insurer. His team achieved a 28% increase in policies per agent by deploying AI in their contact center. Now he's making AI adoption a formal requirement in every employee's 2026 performance review. Here's the blueprint for scaling AI without falling into the 80-92% failure rate that plagues most AI investments.

TLDR:

Definity's contact center AI delivered 28% more policies per agent by focusing on summarization, note capture, and conversation structuring; not trying to replace humans.

Test AI against a narrow challenge with very clear metrics to drive easy wins (you need those early-on)

Give everyone AI tools, showcase quick wins from peers, then formalize it in performance reviews to create accountability.

Start with an efficiency challenge that’s ideal for AI. "Somewhere between 80 and 92% of all investment in AI to date has failed to provide true business value." The reason? Companies buy AI without knowing what problem they're solving. They start with a mandate to adopt AI, and then try to come up with problems, which are often too broad.

Definity took the opposite approach: they focused exclusively on contact center efficiency first.

The AI now handles conversation summarization, note capture, and structuring the conversation flow for agents. The result: agents can handle 28% more policies without adding headcount.

Why start here? Because contact center efficiency has clear, measurable outcomes. You're not betting on hallucination-prone marketing AI or unproven actuarial models. You're reducing handle time and improving consistency.

Democratize access, then mandate accountability. Definity gave all 5,000 employees access to Copilot, Perplexity, and Gemini. But access alone didn't drive adoption. Kennedy's team showcased early adopters in meetings: people who built prompts to renegotiate contracts or present problems to legal. Small wins built culture.

In 2026, they're I'll be measuring people on did they drive the project to conclusion and what did they learn – not necessarily did it make us a million dollars."

What to do about this:

→ Audit your current AI investments against business problems. List every AI tool or pilot you're running. For each, write down the specific business problem it solves. If you can't articulate it in one sentence, pause the investment.

→ Add AI adoption to 2026 performance reviews. Start with your digital and operations teams. Require at least one AI test-and-learn project per department with documented learnings; not just business outcomes.

→ Create peer showcases. Identify your early adopters and give them 5 minutes in leadership meetings to demonstrate their prompts and use cases. Early wins spread faster through stories than mandates.

3. Amwins’ AI adoption experience: why generic LLMs fail in insurance workflows

Upstage Fireside Chat with Steven Beauchem, VP of Digital Solutions at Amwins (Dec. 4, 2025)

Background: Steven Beauchem leads digital strategy for Amwins Group Benefits, one of the largest wholesale insurance distributors in the U.S. After testing generic LLMs and watching them struggle with insurance complexity, his team switched to domain-specific AI for document extraction – and underwriters now refuse to give it up. Here's why narrow-scope AI tools outperform ChatGPT in insurance workflows, and how to choose battles that build organizational AI maturity without taking unnecessary risk.

TLDR:

Domain-specific AI lets the model do the work. With generic LLMs, you're "a very small tail trying to wag a very large dog," but purpose-built tools come pre-trained for insurance documents.

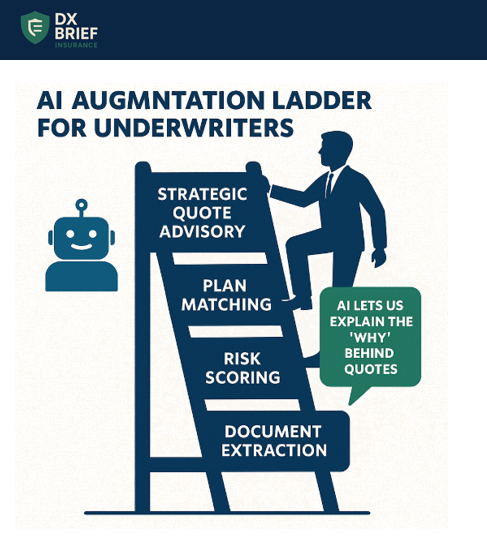

Underwriters are evolving from processors to strategic advisors. AI handles risk scoring, plan matching, and data extraction, freeing underwriters to explain the "why" behind quotes.

Start with document extraction. It's low-risk, demonstrable, and builds permission to tackle bigger problems.

Understand your problem before touching technology. "AI is only as good as you can prompt and provide context. If you're not deep into the weeds – what you're trying to put in, what you're trying to get out – you're ultimately going to struggle."

Insurance has a "target-rich domain" for AI applications. The mistake is thinking too big. Amwins succeeded by narrowing scope to tactical improvements that make people more efficient, not by trying to reinvent insurance. "We've been successful in not trying to think too big at first, but really narrowing our scope on tactical things that ultimately are going to make people better."

Choose domain-specific AI over general-purpose LLMs. With a traditional LLM, "you've got this much you can push into a prompt that's trying to generate an effective result from an expansive domain of knowledge." You're fighting the model's breadth.

Domain-specific tools flip this dynamic. They're pre-trained on insurance documents, so you don't have to prompt-engineer your way to competence. "The attractiveness of a solution that's … narrowly focused on accomplishing things in a specific domain is you don't have to do as much work upfront. You can let the model do the work for you."

For Amwins, this means processing invoices from 40-50 different carriers – each formatted differently – without building custom prompts for every variation. The tool handles edge cases (like plan names encoded in headers) through few-shot prompting rather than manual intervention.

Map the journey to find where AI fits. Beauchem uses design thinking to identify friction points. The team journey-maps every workflow: what systems users interact with, what challenges they face, what's positive or negative about their experience. Then they work backward: What can we solve today? What needs to wait for technology to mature?

The document extraction problem sat on their roadmap for 4-5 years. Only now are they confident enough in the solution to deploy it. "The real value comes when we can go to our major clients and say: because we have this set of capabilities, we can deliver faster value than previously."

What to do about this:

→ Evaluate domain-specific AI vendors for your document-heavy workflows. Identify your highest-volume document types – invoices, applications, claims forms. Test purpose-built extraction tools against generic LLMs on your actual documents.

→ Run a journey-mapping exercise for one underwriting workflow. Map every system, friction point, and user experience. Identify which problems current technology can solve and which need to wait. Pin the "not yet" problems for quarterly re-evaluation.

→ Start retraining underwriters for strategic advisory roles. Begin conversations now about how their role is evolving. Equip them to explain the "why" behind quotes rather than manually calculating risk.

Disclaimer

This newsletter is for informational purposes only and summarizes public sources and podcast discussions at a high level. It is not legal, financial, tax, security, or implementation advice, and it does not endorse any product, vendor, or approach. Insurance environments, laws, and technologies change quickly; details may be incomplete or out of date. Always validate requirements, security, data protection, regulatory compliance, and risk implications for your organization, and consult qualified advisors before making decisions or changes. All trademarks and brands are the property of their respective owners.