The new AI playbook insurers are actually using

Welcome to DX Brief - Insurance, where every week, we interview practitioners and distill industry podcasts and conferences into what you need to know.

In today's issue:

Hiscox's "How to Now" Framework: Moving from AI Pilots to Enterprise-Wide Deployment

How TIAA's COO Orchestrates AI Transformation Across 60% of a 100-Year-Old Workforce

The Agentic AI

1. Hiscox's "How to Now" Framework: Moving from AI Pilots to Enterprise-Wide Deployment

(Re)thinking Insurance Podcast by WTW, Episode: The role of leadership and culture in commercial insurance transformation with Kate Markham, CEO of Hiscox London Market (Nov. 13, 2025)

Kate Markham joined Hiscox 13 years ago to transform their London market business. The - from understanding what AI can do to actually implementing it at scale. Her team now creates value streams where claims underwriters work alongside data scientists on POCs.

TLDR:

Trying and failing is uncomfortable, but it’s actually riskier to NOT try and fall behind

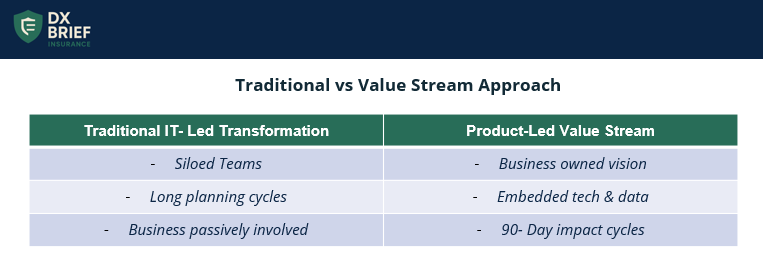

Organize teams into product-led value streams with unified squads: Hiscox created a claims value stream where claims, pricing, data, and technology teams work together toward a common business goal

The framework many insurers miss:

Move from "how" to "now." There’s been a big shift from trying to understand what technology can do to actually trying it, running POCs, and now actually beginning to implement solutions at scale.

But many insurers are still stuck in education mode: endless vendor demos, consultant presentations, conference sessions explaining what's possible. Hiscox moved past that 18 months ago. They're no longer asking "can AI help with claims triage?" They're asking "which claims processes do we automate this quarter?"

If you're still running "awareness sessions" about AI's potential, you're already 18 months behind!

Accept that there's greater risk in not trying than in failed experiments. Here's how Hiscox thinks about AI pilots: "Pick something, try it. If it works, do more of it and roll it out. If it doesn't, go 'okay, not necessarily let's never try that again' but park it. Go do something else."

The critical insight: technology advances so rapidly that failed POCs from six months ago might work perfectly today. So don’t discard “failed” experiments: learn from them and revisit later.

This fundamentally changes how you allocate resources. Instead of demanding guaranteed ROI before starting, you accept that 40-50% of experiments won't scale today and create systematic processes to revisit them quarterly as capabilities evolve.

Build product-led value streams where business owns the vision. When Hiscox tackled claims transformation 18 months ago, they didn't create a "digital claims initiative" owned by IT. They created a claims value stream led and sponsored by the claims team.

The The structure: "It's claims underwriters, it's led and sponsored by the claims team. It's got all of the change people in it. It's got the pricing people. It's got the data. It's got the technology people. They're all together in one squad."

The hard part: "We're dealing with business as usual. All those claims people, they're dealing with claims. And you're saying to them, in addition to that, can you please take this on as well? I need you to come out of the business for four-five days and go work with Google Cloud and do a proof of concept."

What to do about this:

→ Create one cross-functional value stream squad this month. Pick your most urgent business problem (claims cycle time, underwriting efficiency, broker experience). Put the business leader in charge. Embed data, technology, and change management people in the squad. Give them 90 days to demonstrate measurable impact.

→ Schedule quarterly "revisit parked pilots" sessions. Every 90 days, review failed POCs to assess whether technology has advanced enough to make them viable now. Track how many "failures" become successes within 6-12 months.

2. How TIAA's COO Orchestrates AI Transformation Across a 100-Year-Old Workforce

Beyond Boundaries Podcast by Sønr, Episode: Reinventing TIAA: AI, innovation, and transformation (Nov. 12, 2025)

Sastry Durvasula leads four pillars at TIAA: global technology, operations, shared services, and digital/client experience - collectively 60% of the workforce at a company managing $1.4 trillion in assets. His "Apex" initiative (AI Powered Excellence for the Enterprise) isn't a pilot program. TIAA is building agentic AI ecosystems where AI agents from ServiceNow, Adobe, and hyperscalers work alongside proprietary TIAA agents (they hold 50+ patents in retirement technology). The most provocative use case? Using AI to protect customers experiencing cognitive decline from financial fraud.

TLDR:

TIAA uses AI agents from multiple vendors (ServiceNow, Adobe, hyperscalers) plus proprietary agents working together, because "if we're just going to build our agents ourselves, we're never going to be able to scale."

Use venture investments strategically to pilot technology in your ecosystem: TIAA invested in Normal AI through their ventures arm to "commercialize the product within our own ecosystem for our end customers."

As people live longer, cognitive decline increases susceptibility to fraud, so TIAA is building AI systems that monitor customer behavior and engage trusted contacts when cognitive decline appears, potentially "paying for the entirety of our AI investment."

The framework many insurers haven't considered:

Don't build monolithic AI - orchestrate agentic ecosystems instead. "We're building our own agentic AI orchestration layer. On top of this layer, we would have a mix of off-the-shelf agents and internally built proprietary agents. We can orchestrate them as needed based on the task at hand."

TIAA isn't trying to build every AI capability in-house. If ServiceNow has great agents for IT service management, they use those. If Adobe has great agents for document processing, they deploy those. If hyperscalers offer agents for data analysis, they leverage those. Meanwhile, TIAA builds proprietary agents only for retirement-specific capabilities where their 50+ patents give them unique intellectual property.

Many carriers are debating "build versus buy" for AI. Durvasula says that's the wrong question. The right question is "orchestrate or fall behind." You need an orchestration layer that lets multiple AI agents - some bought, some built, some from partners - work together seamlessly.

Turn your ventures arm into your AI pilot ecosystem. TIAA doesn't just invest in InsureTech and RetireTech companies for financial returns. They invest strategically to pilot technologies in their own operations before broader deployment.

"We invested in a company called Normal AI through TIAA Ventures. We're now actually trying to do pilots with Normal AI in our own platform … The reason we have a ventures arm is to drive as many strategic investments as possible so we can commercialize the product within our own ecosystem for our end customers."

TIAA isn't just hoping their portfolio companies succeed in the market. They're actively piloting portfolio company technology internally, providing real-world testing environments and immediate feedback loops. When technologies prove valuable, TIAA scales them across their operations while the portfolio company gains a marquee reference customer.

Use AI to address industry-specific existential risks. "As people live longer … cognitive decline is also increasing. We need to secure retirement assets of people who are more susceptible for financial fraud - whether it's cyber breaches or AI-powered attacks."

TIAA's solution: use AI to monitor customer behavior patterns, detect early signs of cognitive decline, and proactively engage with customers' trusted contacts before fraud occurs. Durvasula describes it as "AI watching your back and protecting you, even working with your trusted contacts that you may have on file."

For life insurers, annuity carriers, and retirement services companies, this represents a completely different way to think about AI value. Most business cases focus on operational efficiency - reducing claims cycle time, improving underwriting speed. Durvasula is calculating AI ROI based on fraud prevention and customer protection over multi-decade relationships.

What to do about this:

→ Audit your current AI architecture for orchestration capability. Map every AI tool, pilot, and system you're deploying or evaluating. Ask: "Do these systems talk to each other? Can agents from different vendors work together? Or are we building siloed AI capabilities?" If you don't have an orchestration strategy, you're accumulating AI debt.

→ Align your venture investments with your operational transformation priorities. If you have a corporate venture arm, schedule a quarterly meeting between venture partners and your COO/CIO. For each portfolio company, ask: "How could we pilot this technology in our operations within 90 days?" Use venture capital as your R&D lab.

3. The Agentic AI Playbook: Insurance Leaders at CNA and Verisk Say "Start Small, Think Big, Focus on Outcomes"

Ian Barkin’s Podcast by magentIQ, Panel: Agentic AI in Insurance with Andy Niver (VP Operations at CNA Insurance) and Richard Smith (Chief Product Officer at Verisk) (Nov. 14, 2025)

Andy Niver (CNA Insurance) and Richard Smith (Verisk) are practitioners implementing agentic AI in real insurance operations. Their unified message: the industry has moved past the "should we?" phase into the "how do we?" phase. But most companies are still making the same mistakes - starting too big, obsessing over technology instead of outcomes, treating AI as an IT project instead of a business transformation. Their tactical playbook? Start small somewhere specific, build confidence in the team and technology, let early wins create momentum, and engage your CFO as a champion (not a gatekeeper).

TLDR:

Start with narrow, achievable pilots that demonstrate value and build team confidence in both the technology and the approach.

Treat your CFO as a transformation champion, not a hurdle: insurance CFOs are increasingly positioned as "true champions of change" who can "spearhead and drive it because of their remit and their view holistically over an organization."

Focus obsessively on outcomes, not technology: "so many times we've seen organizations get distracted by the shiny tech" and then "you're looking to prove out where can I use this tool rather than what do I need to achieve."

Here's what insurance operators know that consultants don't:

Small wins build the confidence required for big transformations. This runs counter to typical transformation playbooks that call for "enterprise-wide digital strategies" and "comprehensive AI roadmaps." Niver has seen those approaches fail.

Small wins do three things simultaneously:

They prove technology works in your specific environment.

They build team confidence in new ways of working.

They create organizational momentum that makes subsequent initiatives easier to approve and staff.

Smith reinforces this: taking small steps is even more important with agentic AI because people will be nervous.

The nervousness isn't about AI capability. It's about organizational change in heavily regulated, risk-averse insurance companies. Small steps reduce the anxiety that kills transformation before it starts.

Get one underwriting team using an AI agent successfully. Get one claims adjuster improving cycle time with AI assistance. Get one broker experiencing faster quote turnaround. Then scale based on proven results.

The CFO is your best transformation ally - if you engage them correctly. CFOs are no longer gatekeepers of transformation budgets. They're increasingly champions of operational change because their remit spans the entire organization.

The key insight: don't approach your CFO asking for AI budget. Approach them as a strategic partner asking "how do we achieve our business objectives?" When AI becomes a means to that end (not the end itself), CFOs become natural champions because they care about measurable outcomes, accountability, and strategic alignment - all of which agentic AI initiatives should demonstrate.

Technology obsession kills more AI projects than technology limitations. David Brain from MagentIQ points out the pattern: "So many times we've seen organizations get distracted by the shiny tech. Then you're looking to prove out where can I use this tool rather than what do I need to achieve. Outcome over tech every day."

This matters because insurance companies are bombarded with AI vendor pitches. Every software provider is adding "AI capabilities." Every consultant is selling "AI transformation services." In that environment, it's easy to fall into the trap of evaluating technology for technology's sake.

Smith frames the corrective: "Working in product, we don't want things to be seen as an IT project. We want things seen as business value. If you can tell people the story of 'we're doing this because this means to your business or your life' and here is the first phase which is added value, that's what matters."

What to do about this:

→ Pick one narrow, winnable AI use case for the next 60 days. Don't launch "enterprise-wide AI transformation." Pick one process in one department affecting one user group. Make it narrow enough that you can demonstrate measurable impact in 60 days. Use that win to fund and justify the next pilot.

→ Schedule a strategic planning session with your CFO this month. Don't ask for AI budget. Present your business objectives for the next 12-24 months. Ask: "What operational constraints prevent us from achieving these objectives?" Then explore how AI might remove those constraints. Let the CFO become a co-author of your AI strategy, not a reviewer of your AI budget request.

Disclaimer

This newsletter is for informational purposes only and summarizes public sources and podcast discussions at a high level. It is not legal, financial, tax, security, or implementation advice, and it does not endorse any product, vendor, or approach. Insurance environments, laws, and technologies change quickly; details may be incomplete or out of date. Always validate requirements, security, data protection, regulatory compliance, and risk implications for your organization, and consult qualified advisors before making decisions or changes. All trademarks and brands are the property of their respective owners.